Just How Livestock Threat Protection (LRP) Insurance Policy Can Secure Your Animals Investment

Animals Risk Security (LRP) insurance policy stands as a trusted shield versus the uncertain nature of the market, supplying a critical strategy to protecting your assets. By delving right into the details of LRP insurance policy and its complex advantages, animals producers can strengthen their financial investments with a layer of safety that goes beyond market changes.

Understanding Animals Danger Protection (LRP) Insurance

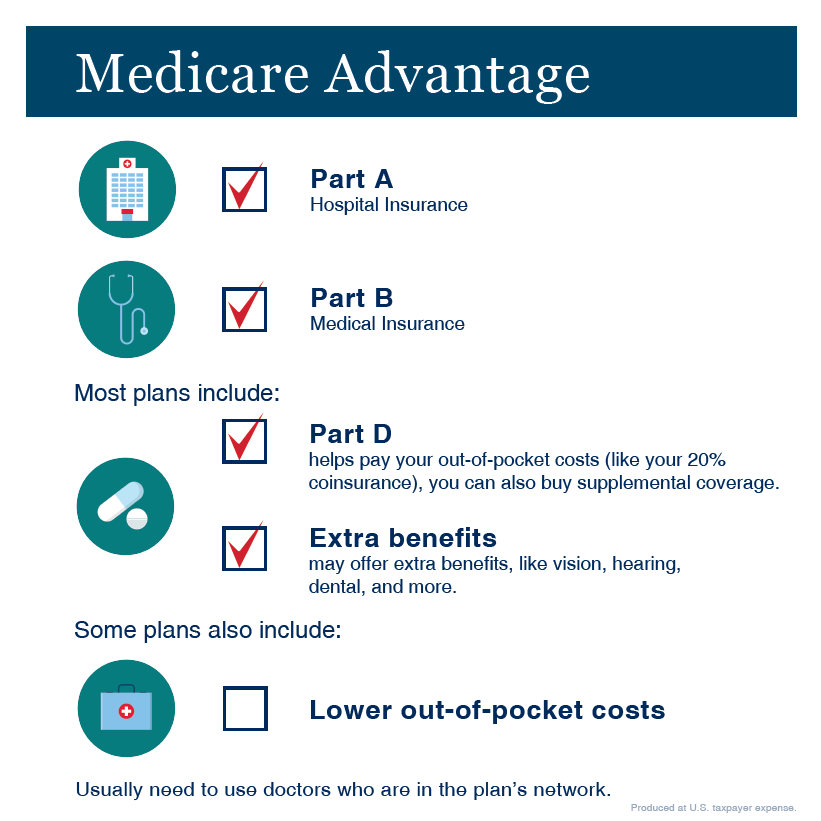

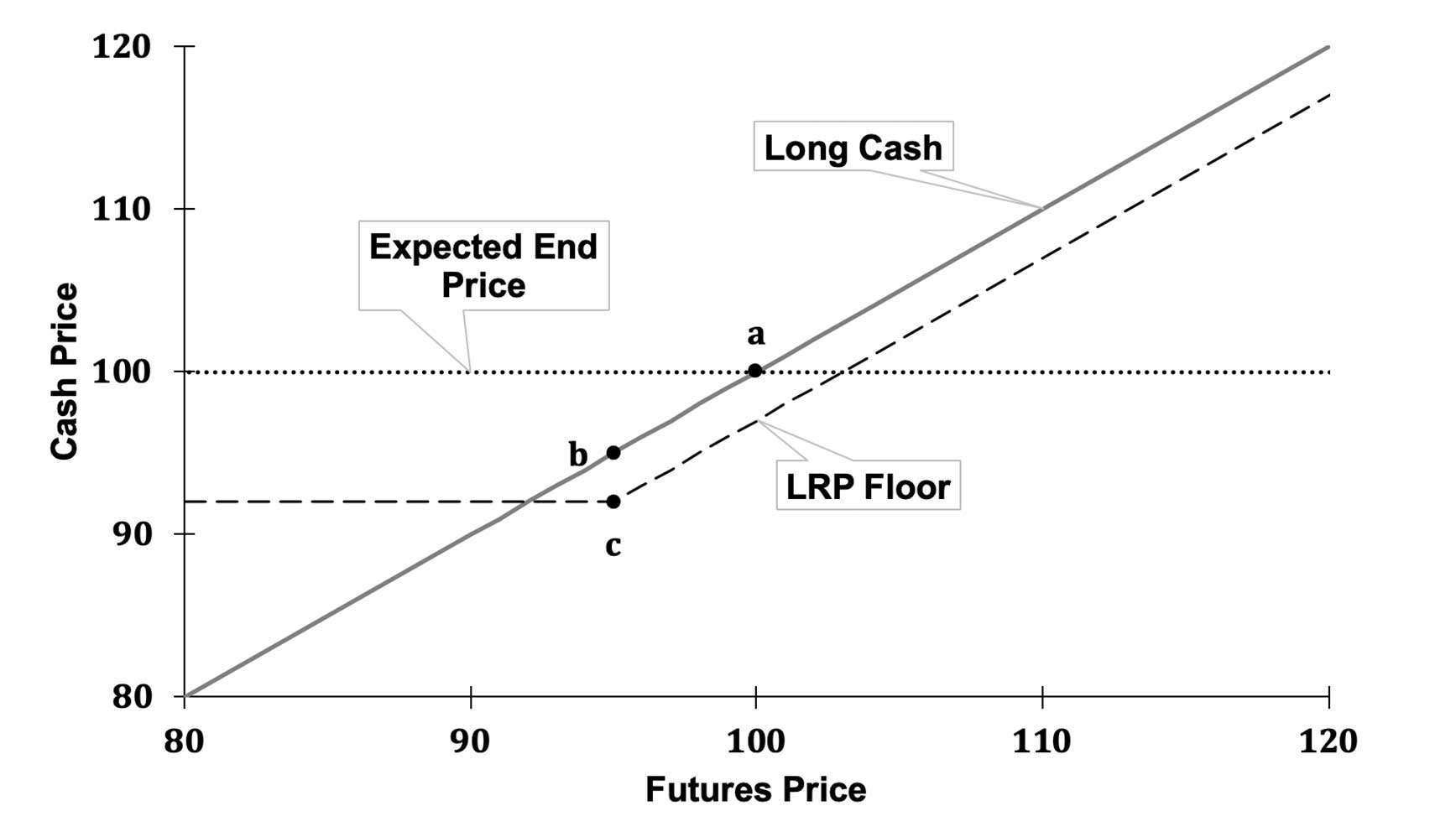

Recognizing Livestock Threat Security (LRP) Insurance is necessary for livestock manufacturers wanting to mitigate monetary risks related to price changes. LRP is a federally subsidized insurance coverage product created to protect manufacturers versus a decrease in market rates. By offering insurance coverage for market value decreases, LRP helps producers secure a floor cost for their animals, guaranteeing a minimal level of profits despite market changes.

One trick aspect of LRP is its versatility, allowing producers to tailor coverage levels and plan sizes to suit their particular demands. Manufacturers can choose the number of head, weight variety, insurance coverage price, and protection duration that straighten with their production goals and run the risk of tolerance. Recognizing these customizable choices is vital for manufacturers to effectively manage their cost danger direct exposure.

In Addition, LRP is readily available for various livestock types, including cattle, swine, and lamb, making it a flexible danger monitoring device for animals producers across different industries. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make educated choices to protect their financial investments and ensure financial security despite market unpredictabilities

Advantages of LRP Insurance Policy for Animals Producers

Animals manufacturers leveraging Livestock Risk Defense (LRP) Insurance coverage acquire a strategic benefit in protecting their investments from rate volatility and protecting a stable economic ground in the middle of market uncertainties. By establishing a floor on the rate of their animals, producers can mitigate the threat of considerable financial losses in the occasion of market downturns.

Furthermore, LRP Insurance policy provides manufacturers with satisfaction. Knowing that their investments are safeguarded versus unanticipated market modifications enables manufacturers to concentrate on other facets of their business, such as boosting pet health and wellness and well-being or optimizing production processes. This assurance can bring about raised performance and success in the future, as producers can run with more confidence and stability. In general, the benefits of LRP Insurance coverage for livestock producers are considerable, providing a useful tool for handling danger and making sure economic safety in an uncertain market atmosphere.

How LRP Insurance Policy Mitigates Market Risks

Alleviating market threats, Animals Threat Defense (LRP) Insurance provides animals manufacturers with a trusted guard versus price volatility and financial unpredictabilities. By providing defense against unanticipated cost declines, LRP Insurance coverage aids producers safeguard their investments and preserve financial stability despite market fluctuations. This kind of insurance coverage permits livestock producers to secure a price for their animals at the start of the policy period, making certain a minimum cost degree despite market modifications.

Steps to Safeguard Your Animals Investment With LRP

In the realm of agricultural danger management, implementing Animals Risk Security (LRP) Insurance policy involves a tactical process to secure financial investments versus market variations and unpredictabilities. To secure your livestock investment effectively with LRP, the very first step is to examine the certain threats your procedure encounters, such as rate volatility or unanticipated climate occasions. Next off, it is crucial to research and select a credible insurance policy provider that offers LRP plans customized to your animals and service requirements.

Long-Term Financial Safety With LRP Insurance Coverage

Making sure withstanding financial security via the use of Livestock Risk Protection (LRP) Insurance policy is a sensible long-lasting strategy for farming producers. By incorporating LRP Insurance policy right into their danger management strategies, farmers can secure their livestock financial investments versus unanticipated market fluctuations and adverse occasions that might jeopardize their economic wellness in time.

One key advantage of LRP Insurance coverage for long-term economic safety and security is the comfort it supplies. With a reliable insurance plan in position, farmers can mitigate the economic risks linked with unpredictable market conditions and unanticipated losses due to variables such as illness episodes or all-natural calamities - Bagley Risk Management. This stability allows manufacturers to focus on the everyday operations of their animals business without continuous fret about prospective monetary setbacks

In Addition, LRP Insurance gives a structured technique to managing danger over the long-term. By setting certain coverage levels and selecting suitable endorsement durations, farmers can customize their insurance coverage prepares to align with their monetary objectives and take the chance of tolerance, making sure a lasting and protected future for their animals operations. To conclude, purchasing LRP Insurance policy is an aggressive strategy for agricultural producers to accomplish long-term economic security and safeguard their incomes.

Verdict

In verdict, Animals Threat Defense (LRP) Insurance policy is a valuable tool for livestock manufacturers to mitigate market risks and secure their financial investments. By understanding the advantages of LRP insurance policy and taking actions to apply it, manufacturers can accomplish long-lasting monetary safety and security for their operations. LRP insurance provides a safety net versus rate changes and makes sure a level of stability in an unpredictable market setting. It is a sensible option for protecting livestock financial investments.